The Ultimate Guide To Joseph Hoell Insurance

How Joseph Hoell Insurance can Save You Time, Stress, and Money.

Table of Contents7 Easy Facts About Joseph Hoell Insurance ExplainedUnknown Facts About Joseph Hoell InsuranceFacts About Joseph Hoell Insurance Revealed7 Easy Facts About Joseph Hoell Insurance ShownGet This Report about Joseph Hoell InsuranceHow Joseph Hoell Insurance can Save You Time, Stress, and Money.

Home insurance coverage, additionally described as homeowners' insurance policy, is not needed by the legislation. A lot of lending institutions, nonetheless, set it as a condition for securing a home mortgage. Homeowners' insurance coverage might function differently, depending on numerous elements, consisting of where your house is located, but a lot of use the following protections:The material and opinions offered on this site have not been offered or commissioned by any kind of issuer of the economic products and/or solutions appearing on this website. The web content and viewpoints have actually not been examined, authorized or otherwise supported by a provider. Offers may be subject to alter without notice.

Kinds of insurance include life, health, auto, home, disability, and organization insurance policy. Each sort of insurance policy has its own set of protections and exclusions. To pick the best plan for you, consider what you want to shield and just how much protection you need. It is important to weigh your choices when going shopping for insurance coverage.

Some Known Questions About Joseph Hoell Insurance.

If you do not yet have a permanent work that offers medical insurance, and you aren't covered under a moms and dad or guardian's policy, it's important to search for your plan. Wisconsin Insurance Agency. To find the very best policy with budget-friendly month-to-month costs, you have options. https://www.reddit.com/user/jsphh1lnsrnce/. You can utilize an agent to aid you in browsing with your options and choosing a deductible and protection limits

A representative or broker can be specifically handy if you require guidance in understanding your alternatives and making educated choices. The majority of states require all chauffeurs to carry an energetic automobile insurance policy. You could encounter penalties for damaging the legislation and driving without insurance coverage. There is also the possible price of damages and medical costs you are accountable for if you are discovered to blame for the mishap.

You require to check to learn what your state's minimum coverage alternatives are when choosing a policy to make certain you fulfill these requirements. When it involves cars and truck insurance, you have the adhering to choices: insurance coverage is frequently the minimal protection needed by the majority of states. This sort of automobile insurance helps to pay for the expense of home damages and injuries to others when the mishap is your mistake.

Rumored Buzz on Joseph Hoell Insurance

insurance coverage (UM/UIM) pays clinical expenses, lost earnings, and various other compensations to you and your travelers to cover your losses, if an uninsured or underinsured driver is at fault. Vehicle damages is covered under this policy in some states. (PIP) assists to pay for clinical costs, shed incomes, and more for on your own and any of your travelers despite mistake.

insurance policy helps to cover repairs and substitute required after theft Source or damage to your automobile triggered by criminal damage or an act of nature, such as a weather occasion, dropping object, or pet strike. insurance coverage is one more optional coverage. It spends for the repair services or replacement of your automobile following a crash, regardless of mistake.

Our Joseph Hoell Insurance Diaries

As the renter, your personal building is not covered under the proprietor's insurance coverage policy. Renters insurance policy pays to replace harmed or stolen belongings such as furnishings, clothes, and electronics.

Long-lasting care is commonly taken a demand for older individuals, yet you can never ever predict what will certainly take place in your life. Any person of any kind of age might find themselves facing an unfortunate illness or injury that leaves them needing day-to-day aid with the most fundamental things. Long-lasting care helps to cover the costs linked with at home support for day-to-day tasks and personal care, taking care of home treatment, and other kinds of assisted living.

Some Known Questions About Joseph Hoell Insurance.

You can access this cash money worth if you need additional funds for an important expenditure. Many people leave the cash money worth intact to utilize during retired life or to boost the survivor benefit for their recipient. The other kind of policy is term life insurance policy. This one provides you protection at a locked-in rate for a pre-specified size of time.

While your plan is active, your premiums continue to be the exact same. If you pass away throughout this time, your designated recipient obtains the survivor benefit. As soon as the term size goes to an end, you are no more covered unless you renew the plan. benefits pay for more than simply funeral expenditures.

The 6-Minute Rule for Joseph Hoell Insurance

Not every sort of financial obligation is forgiven if you die, specifically if you have a cosigner who is also legitimately responsible. Acquiring a term life insurance policy covers the costs of your recognized expenditures and financial obligations so you don't leave an economic concern for your loved ones. Auto Insurance Wisconsin. Selecting the policies that offer the best value is very important to manage your finances and remain within your spending plan

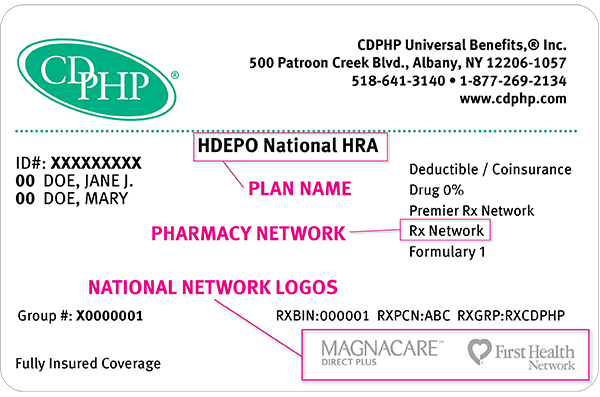

View this video clip to discover more concerning our state-specific resources. An insurance policy manufacturer certificate permits individuals to sell, obtain or work out insurance coverage products. To run legally, insurance policy producers must hold a valid certificate from all the states where they work. Condo Insurance Wisconsin. This guarantees they fulfill sector standards and adhere to state regulations, safeguarding both the producer and the consumer.